Curated Resources:

Kickstart Your Fundraising

- Using Customer Discovery to Help Your Startup Raise Money (The 6% Rule)

- Why Most Entrepreneurs Hate Fundraising (and How to Fix It)

- The Three Words No Early Stage VC Wants to Hear, Aaron Dinin, Medium

- How to Determine the Amount to Raise in Your Financing Round (YouTube)

- A Large Equity Financing Can Kill Your SaaS Business: Two different paths to growth and outlines ways founders can identify whether equity capital will help or hinder their business in the long run, Michael Walkinshaw, TIMIA Capital

- Why I'll Sometimes Fund a Startup and Tell Them to Stop Making Money, Hunter Walk, March 2019

- The 1 Reason Investors Are Ignoring Your Startup Opportunity (Hint: Research)

- An Investor's Take on Investing in SaaS KPIs - Worthy Investments

- Should You Pay $50K for your Pitch Deck? Yes, Why the Hell Not?

- Startups Don't Have to Fail, Irwin Stein

- 22 Mistakes Entrepreneurs Make When Pitching to Investors

- 5 Things Entrepreneurs Must Keep In Mind When Fundraising, Alejandro Cremades

- 11 Fundraising Ideas for Entrepreneurs Who Don't Want VC Money

- Pre-Seed vs. Seed Funding: Understanding the Benefits

- The Five Pillars of Seed Stage Funding

- How SaaS Startups Go From Seed Funding to Series A - very good!

- Series A, B,C Funding: Averages, Investors, Valuations, Fundz

- There are Only 3 Startup Stages, Gil Dibner, Angular Ventures

- The SaaS Metrics That Led to a $10M Series A

- Sample VC Due Diligence Request / Checklist, Cooley (PDF)

- CrossBeam Announces $25M Series B to Keep Growing Platform, TechCrunch

- Growth and Traction for Early Stage Startups Seeking Fundraising, Seedcamp

- The Rise of the Seed II Round (and Why It's Great for Enterprise Founders), Jessica Lin, WorkBench - Excellent!

- Proprietary Deal Flow is Dead: The Future of VC is Proprietary Insights (- due diligence from a Corporate Network, Panel, Scouting, Portals or Events in a Thematic Area of Interest), Jonathan Lehr, WorkBench - Excellent!

- A Peek Inside Sequoia's Low-Flying Wide Reaching Program, TechCrunch

Valuation & Vesting & Cap Tables

- Plan Ahead to Achieve Valuation Step-Ups, Forbes - Excellent!

- How Startup Valuation Works (InfoGraphic + Explanatory Text), Adioma - Excellent!

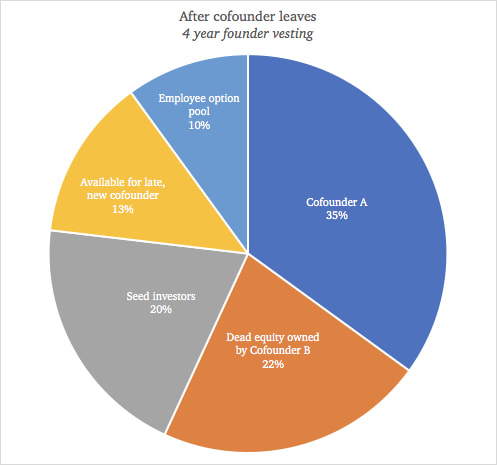

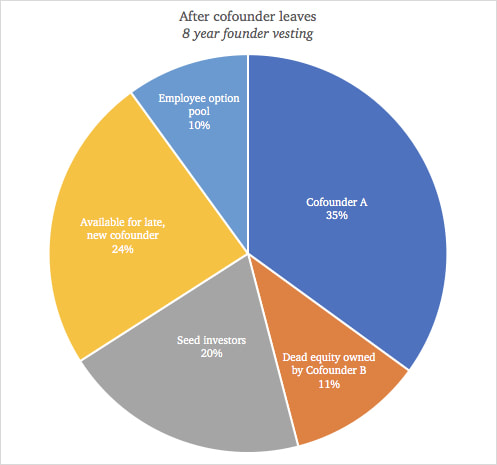

- 4-Year Founder Investing is Dead, Jake Jolis, in ExtraCrunch

- 4 Things Investors Secretly Look for in Your Cap Table

- Startup Cap Table (4-year vs. 8-year vesting) (see pie chart)