|

The Power of

Customer Discovery Customer Discovery is an essential part of your toolkit to understand what customers need and are willing to pay for. Read more...

|

|

|

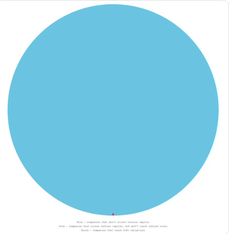

Use Customer Discovery for Better

Funding Success with VCs Hint: look for the red and black dots.

The odds of raising VC money are staggering - against you. This amazing visualization tells the incredible story. Learn more... |

US Market Readiness

Getting Ready for the US Market

Market entry to the US is complex, expensive and time-consuming. Make sure you get a head-start! Learn more... |

RSS Feed

RSS Feed